Panama has properties for all interests and prices located in the city, at the beach, in the mountains, in jungles, and even on islands, which are ideal for real estate investment. In addition to ensuring the protection of private property, there are several different incentives for the investor. Today we are going to talk about the five things you should know about property tax.

- What is property tax?

The property tax is the tax burden assigned by the State to real estate projects. This is calculated according to the cadastral value of the property according to Law 66 of October 17, 2017, which modified the Panama Tax Code and which came into force as of January 1, 2019.

2.- What are the taxes that must be paid and to whom does it correspond?

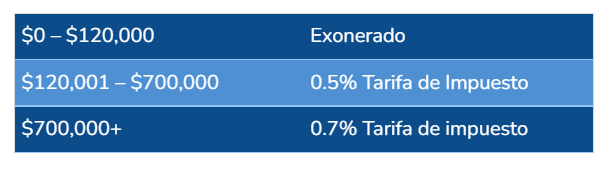

There are two: the first is Real Estate Tax (IBI), which is levied on the ownership or possession of the real estate. It is not fixed and depends on the good purchased and certain benefits apply to certain sections. It is also important to point out that according to the last modification, properties destined for family assets or first homes have different sections.

For this tax, there is a benefit of a 10% discount for early payment.

On the other hand, this Real Estate Transfer Tax (ITBI) taxes the transfer of property, that is, when there is a transfer of property from one owner to another, and applies the 2% to the greater value of the purchase deed sale registered in the Panamanian Public Registry or the value registered in the Cadastre office. This payment must be made before signing the sale.

- What is the cadastral value of the property?

The cadastral value of the property represents the tax base on which the State calculates the property tax and can have two components: the value of land and the value of improvements.

As the web page www.advance.com.pa points out, “The value of the land is used to calculate the property tax in those cases in which the property is land without declared improvements, or when the property is within the exemption period of tax on the value of improvements. Once the exoneration period has expired, the calculation of the tax is made on the cadastral value of the property, including land and improvements.

4. What are the ranges on which the payment of taxes is based?

5. How can I verify the cadastral value of my property in the DGI?

This information can be obtained on the website of the General Directorate of Revenue of the Ministry of Economy and Finance (DGI). For this, you need to have the corresponding Tax Identification Number (NIT).