The vision of a foreign investor

James Li, COO of Pensio, a company that focuses on offering its clients property management and guaranteed investment income programs, tells us a little about what caught their attention about the country.

“Our search and research on the best emerging markets in real estate and opportunities to partner clearly resulted in Panama as our primary focus, always topping the charts for all the right reasons to invest.”

For some, Panama is the Manhattan, London or Hong Kong of Latin America with multiple shopping centers, restaurants and nightlife. It is extremely safe to live in Panama and for investors to obtain Permanent Residence.

Panama has the best tax system in the world. There are several emerging companies in technology, investment and construction, restaurants, shops and business sectors.

Panama is a beautiful ecological park and the only country in the world that combines city life with beaches and ecotourism. It has the greatest biodiversity in the world, with beaches, mountains, forests, rivers and reefs in both the Pacific and the Caribbean just a few hours away from the capital.

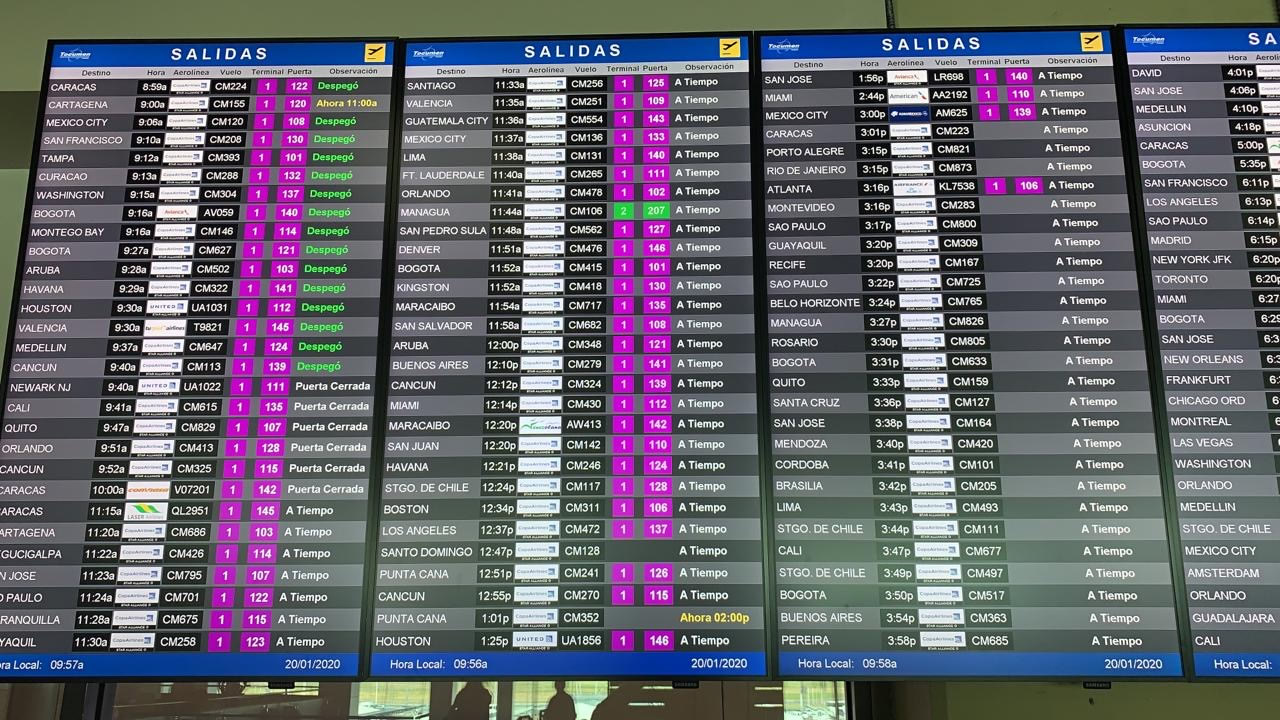

Panama has a new international airport, with flights to all the main destinations in the world.

Private education is offered in Chinese, Greek, English, French, Italian, and Spanish. There are many university options, and children of Permanent Residents who want to study in America can easily obtain a student visa as a Permanent Resident of Panama.

The private healthcare system is accessible and one of the best private systems in the world today, one of the reasons why it was rated one of the best places to live.

Panama ranks as the 42nd most competitive economy in the world and the 2nd in Latin America, surpassed only by Chile. On average, the residential and vacation resort real estate market has appreciated 8% annually for the past six years.

Panama is one of the best places to retire in the world, according to an International Living report published in Forbes.

The Panamanian Business Ecosystem.

Panama has been for more than a century an important piece for the commercial growth of the entire region and the world. Not only from a commercial or corporate point of view, the different reforms also involve the civil sphere. Any person that meets the requirements may join the national workforce and use the instruments that it grants in order to comply with the improvement of their quality of life and international patrimonial planning.

These are some relevant aspects when considering starting a business in the country.

Dollarized economy

The use of the US Dollar as the legal currency has allowed the country to develop a world-renowned banking market, by being able to provide stability in deposits as well as develop credit products at better terms since there is no risk of devaluation.

In the past, it allowed it to maintain a low inflation rate, which created favorable conditions to reach a high level of development and be one of the main attractive economies for foreign investment.

This recognition is given by the three main global risk rating agencies S&P, Fitch and Moody’s, who have rated the country with investment grade BBB +, BBB and BAA respectively, putting the country at the same level as others such as Chile, Mexico, Peru , Uruguay, Colombia, and first in Central America.

Therefore, if your interest is to use Panama as a place to do business, keep in mind that the dollar is the official currency. And if you come to visit, do not be surprised when paying in cash you might receive a combination of American and local currencies such as the ‘Martinelli’ (named after the president who decided to issue coins with a value of one dollar ) or the ‘cuara’ (the traditional 25 cents).

Societies

For years, Panama has created a series of public policies to attract foreign capital through a series of laws that promote legal security and protection for the investor and for all qualified professionals who come to provide services in the country.

Panamanian legislation has several options for legal structures for businesses, but the most widely used is the ‘Anonymous Society’, due to its flexibility and easy handling for both local and international operations. One of the advantages offered by these companies is that they can carry out activities that are not subject to tax in the country.

Law 32 of 1927, which regulates Corporations in Panama, has unique and special characteristics, which make it favorable not only for nationals, but also for Non-resident foreigners in Panama, who need some legal form with which to carry out their commercial and business activities abroad.

Its operation rests on the principle of the formulation in the Civil Registry of the Articles of Incorporation, under which the participation of a shareholder, two Panamanian lawyers and the participation of a minimum of three signatures is required.

At a general level, the average time to open this type of company under the stated categories in the country, has a duration that does not exceed six days.

Legal Security and Promotion of foreign investment

Law 54 of July 22, 1998 establishes that foreign investors and the companies in which they participate have exactly the same rights and obligations as nationals, with no limitations other than those established in the Constitution and the law. Of course, the law is clear in indicating those strategic areas where only Panamanians can participate.

Panama has strived to develop a unique ecosystem for business development. Through the publication of Law 57 of October 24, 2018 that reforms Law 41 of 2007, which creates the special Regime for the establishment and operation of Multinational Companies Headquarters (SEM) and the Multinational Companies Headquarters Commission, establish new rules for SEM companies.

Today there are more than 150 multinational companies that have established their headquarters in Panama, taking advantage not only of the regulatory and economic benefits, but also of its strategic location and logistics development. These companies include Procter & Gamble, Adidas, Halliburton, Dell, Bayer, Caterpillar, Bauer, Phillips, Nestlé, among others.

This law not only provides benefits for companies, but also to the top executives who work for them.

Fiscal and tax benefits

From the legal point of view, a total of 21 types of tax benefits can be identified in Panama. The variety of areas that this categorization encompasses is very extensive and rich.

All this represents a totalized system that responds both to the social, political and public needs that the country has experienced during its recent history, framed by the permanent objective of attracting international and foreign investment to the national territory.

In addition, Special Economic Zones have been developed that contribute to enhancing its strategic position and become the perfect platform for business development. These areas include special tax, labor and immigration benefits. Some of these areas are:

- City of Knowledge

- Panama Pacifico

- Export Processing Zones

- Free Zone in Colon