On April 19, 2019, Charles Burrows, an English financial consultant living in Panama, wrote an article about how ‘positive’ figures in the global economy were none other than clues of an upcoming new global recession. The Coronavirus pandemic was the catalyst that presents new and better opportunities for investors.

From euphoria to desperation. The global economy is being affected by a health phenomenon never before seen in this generation and the consequences have been disastrous for most people.

Charles predicted this a year ago. And expressed it to most of his international clients at the Empire Consulting Group, a financial planning and asset management company, who are looking towards the market storm with ease, even generating profits.

From his office in Coronado, one of the best beach areas in Panama, the advisor spoke to us about the current state of the economy and the amazing opportunities that this crisis will create.

However, it is not possible to avoid asking him why he chose the country to live as well. “Panama was an obvious choice for me given that my business is international. It offers tax incentives, has a neutral time zone, excellent flight routes and it is a great place for business.

In Panama, you get to meet entrepreneurs, businessmen and executives from all over the world. Very few places can offer all of this combined with good quality of life,” stated Burrows.

P.L: You spoke about a financial collapse a year ago. What was your analysis based on?

C.B: The value of corporate bonds and actions had been significantly overvalued for too long and a collapse or correction of the market was delayed.

I wrote an article about this last year in LinkedIn that stated that the price/profit relationship of actions was at the level seen before the Great Depression and higher than the prices seen right before the collapse of the dot.com in 2000 and the financial crisis of 2008.

I also demonstrated that the unemployment rates at their highest point are precursors of a market collapse because they are an indicator of the strength or weakness of an economy. The virus acted as a catalyst and sunk stock exchange markets rapidly.

P.L: Was the global economy prepared for an issue such as this one?

C.B: No, the complete opposite. It was completely ill prepared in every sense. The actions taken by the governments were far too slow. Sadly, people are more concerned about money than about health.

Even now, most countries are suggesting they lift the blocks to save the economy. Personally, I do not think a recession can be avoided at this time and the main objective should be the health of the community, not the economy.

The economy was going to collapse at some point, as it does in all economic cycles as I had explained it last year. So, why not allow it to have its natural correction? Putting the economy above the health of the community can be dangerous.

As people continue to see relatives and friends pass away, they feel that the government does not care which increases panic and fear. This is how hate towards the government can generate civil disruptions and more problems.

P.L: What is the real impact on the global economy?

C.B: It is huge since everything is interconnected. It is a big domino effect. Stock exchange markets collapse, companies reduce their size, jobs are lost, the dollar increases creating inflation in emerging markets that are not dollarized, interest rates increase to combat inflation, people stop paying their debts, businesses and banks declare bankruptcy because people are not paying their loans and debts.

The demand for houses and mortgages drops. People with money in the bank lose their money as banks sink, pensions are lost, savings are lost and we live in an important recession.

The impact that we are expecting is at least a 50% CRASH (if not higher) and a 1-2 year recession. But this does not mean that we lose everything. On the contrary, this is the time to take advantage and increase savings and investments.

P.L: What happens to supply chains?

C.B: A big problem today is the concentration of regions that provide goods and services. For example Brazil producing food and China producing all the resulting manufacturing.

When a country has an important problem, it leads to a complete closure of the supply chain, which means that basic products and essential materials are not available.

This leads to an increase in panic and fear, which leads to extreme reactions that give way to poor decisions that worsen the recession even more. If manufacturing and agriculture were more diverse, the economy would not have been as affected but closed only in China.

However, new opportunities can come from this. It is possible that in the future we will see a focus on, for example, diversifying the production and manufacturing of food. This is really good for Panama, since it is considered an element of efficiency for production and transportation to multiple regions due to its location.

P.L: What will happen after this? What are the opportunities for Panama?

C.B: Without a doubt, the future economy will grow after the recession. Certain sectors will suffer and others will grow. E-commerce, online services and education, for example, will become a common habit in which many people will partake from home, which means they will not need to go to their office.

This will mean that more people will be able to choose what country to work for and Panama will benefit immensely from this, since there will be digital nomads looking for attractive places to work from.

I also think that global shipping and air freight will also increase as people become more accustomed to ordering online. And Panama as a logistic hub can take advantage of this reactivation to promote its attractions.

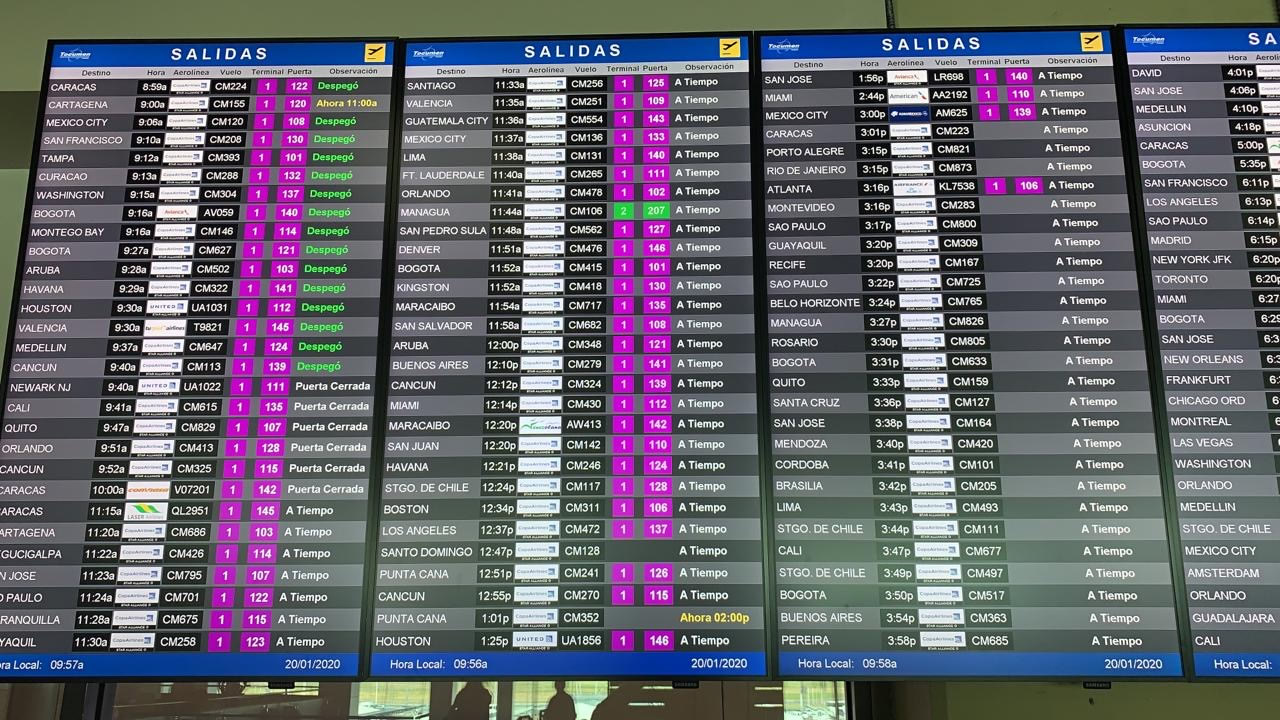

The expansion of the Canal for super ships and the expansion of Tocumen mean that the country is ready to take this role on. An additional benefit is that the recession will decrease the value of land and properties from what they currently cost, thus intelligent investors could see this as a great opportunity. Global interest rates are at zero right now, making real estate investments much more attractive.

Panama, a gem to discover.

Burrows has chosen the beautiful beaches of Cocle as his headquarters. A Panamanian touristic paradise only 90 minutes from the city. In it you can find most luxury tourism complexes, marinas and golf courses.

Furthermore, its proximity to mountains transforms it into a preferred sport for most expats that hold this place as the perfect spot to hold their business.

For the consultant, one of the biggest weaknesses of the country has been not knowing how to sell themselves at an international level. “The lack of knowledge that foreigners have about Panama is incredible.

They hold stigmas from the past that give it an unfair reputation such as a money laundering hub and tax evasion center. Panama does not help itself by not promoting its attractions.

For example, it is the best place for retirement for Europeans, and United Kingdom nationals have no idea that this is an option. Panama needs to work on educating so people know what they have to offer. It is truly a hidden gem that most people completely disregard.”

P.L: What are Panama’s economic strengths?

C.B: Without a doubt, it’s geographic location, the ease with which you can do business and the americanized systems. It is, by far, the simplest of Latin American countries and the least bureaucratic.

The port and the airport are excellent assets, the tax system is also a big attraction.

Panama has incredible natural beauty in the Pacific and Caribbean, mountains and tropical rainforests. There is a lot to see and do here, but nobody knows about it. I am still discovering new attractions and beautiful places all the time.

P.L: What are the advantages for investment in Panama compared to other countries in the region?

C.B: Many, starting with foreign property laws, the tax system, efficient legal processes, a solid banking system and a dollarized economy.

Furthermore, it is a safe country, with good quality of life, a good expat community where you can speak English, direct access to anywhere and incredible natural beauty.

P.L: Which sectors of the country’s economy would you recommend investing in?

C.B: The geographical location of Panama as a center combined with the recent expansion of Tocumen and the Panama Canal give it a privileged position that benefits from global changes we may experience.

The tax benefits will definitely make Panama an attractive option for manufacturing enterprises that need to distribute worldwide.

P.L: And the real estate market?

C.B: The real estate market is an important part of a well diversified investment portfolio.

Panama offers some true gems. If you consider the geographical location of Panama, the weather, the foreign property laws, taxes, natural beauty, security, quality of life, etc.

You cannot find properties at a better price with the benefits that Panama has to offer anywhere else. Charles will continue to advise his global clients from his Panama office. Providing necessary information to ensure the continued growth of their heritage.

This information was developed by Panama Living, a digital platform committed to collecting, researching, and disseminating all the necessary information to turn your interest in Panama into a pleasant and enriching experience.